Real-Time Data Sync in Finance: Modernize Without Rebuilding Your ETL

Modernize financial data infrastructure with real-time change data capture (CDC) without rewriting legacy systems. Estuary streams data from Oracle, SQL Server, and more to Snowflake, BigQuery, and other cloud platforms.

Financial institutions are under growing pressure to modernize their data infrastructure. Between increasing regulatory demands, customer expectations for real-time insights, and the rise of AI and advanced analytics, legacy batch ETL pipelines and siloed systems are becoming blockers.

But for many teams, modernization feels risky. Core systems like Oracle, SQL Server, or even mainframes can’t simply be replaced overnight, and rewriting legacy pipelines from scratch can take months.

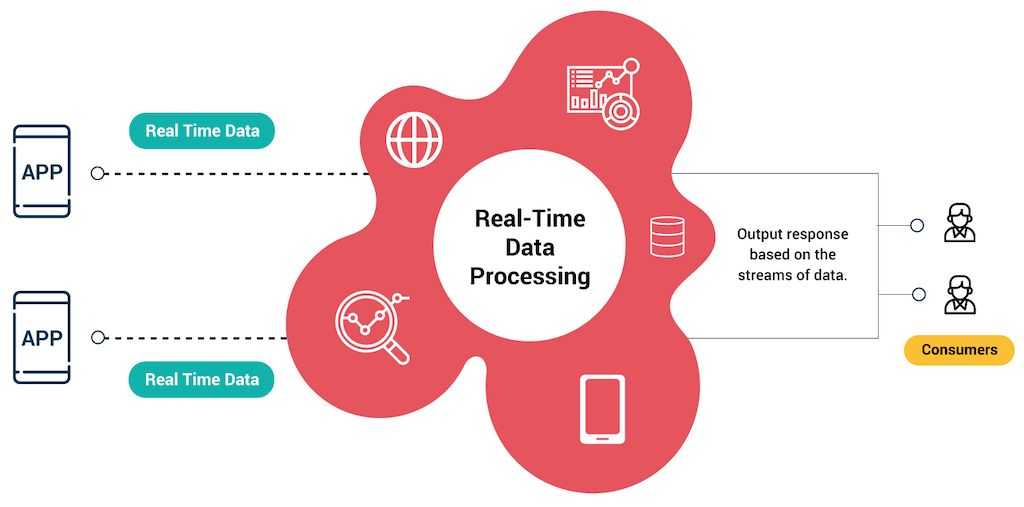

That’s where real-time change data capture (CDC) and streaming data pipelines come in. With the right tools, financial organizations can modernize incrementally, migrating to the cloud, enabling real-time reporting, and reducing batch overhead without rewriting everything.

Why Real-Time Sync Matters in Finance

In financial services, timing is everything. Whether it’s fraud detection, real-time trading dashboards, or internal risk analytics, stale data can lead to costly decisions.

Traditionally, financial institutions rely on batch ETL pipelines that:

- Run nightly or hourly, introducing latency

- Increase infrastructure and compute costs

- Require constant maintenance and scheduling

- Complicate regulatory compliance due to data drift

Modern cloud data warehouses like Snowflake, BigQuery, and Databricks support advanced analytics and machine learning workflows—but to take full advantage, you need a way to deliver fresh data from legacy systems continuously and reliably.

That’s where streaming pipelines and real-time CDC change the game.

How Estuary Helps Financial Institutions Modernize

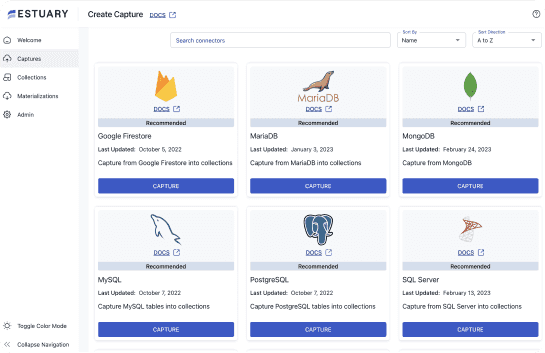

Estuary is a real-time data operations platform that enables you to build and manage streaming pipelines using change data capture (CDC). It connects legacy systems to modern data platforms without the need to rewrite legacy logic or custom pipelines.

Key benefits for finance teams:

- Non-intrusive CDC from sources like Oracle and SQL Server

Estuary captures row-level changes in real time using native database log parsing. It minimizes system load and avoids full table scans or batch queries whenever possible. - Real-time sync to modern data platforms

Send data to Snowflake, BigQuery, Redshift, and other modern analytics tools without delay. - Low-code/no-code pipeline creation

Use a declarative UI or CLI to build dataflows. No need to maintain complex scripts or orchestrators. - Schema evolution support

Automatically detects and adapts to schema changes at the source, maintaining consistency across systems. - Resilience and observability

Estuary guarantees exactly-once delivery semantics and provides built-in monitoring and versioning to meet compliance and auditing needs.

Estuary is designed to handle the scale, security, and complexity that financial data pipelines demand. Whether you're syncing real-time trades, transaction data, or risk metrics, Estuary helps you modernize without disrupting your core systems.

Learn more about how Estuary supports data integration in the finance industry.

Common Use Cases with Estuary in Finance

Estuary supports a wide range of finance-specific data workflows, including:

- Retail banking

Sync customer transactions from Oracle to BigQuery to power real-time fraud analytics and balance alerts. - Wealth management

Stream portfolio data into Snowflake to feed personalized dashboards and investment recommendations. - Insurance

Deliver real-time updates from claims systems to data lakes for fraud detection and underwriting models. - Capital markets

Power real-time trading analytics by syncing SQL Server tick data into cloud-native OLAP stores.

Each of these use cases benefits from low-latency delivery, pipeline observability, and the ability to evolve data models over time—without ripping out existing systems.

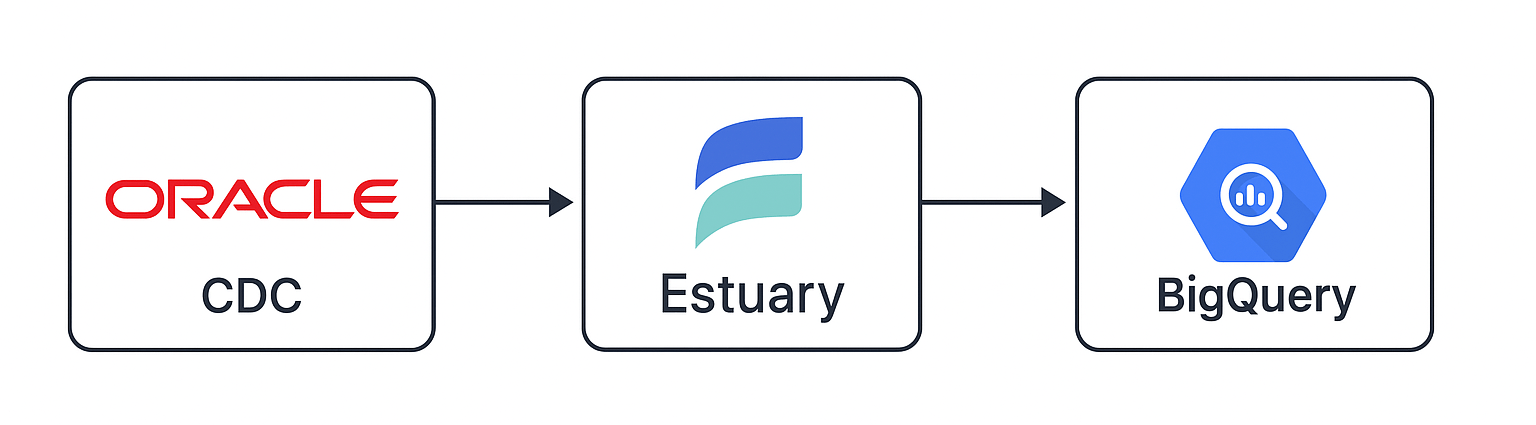

Example Workflow: Oracle to BigQuery for Real-Time Risk Reporting

Let’s say your risk and compliance team wants faster visibility into risk positions and exposures. The relevant data lives in an Oracle database, updated constantly by your transaction systems.

Instead of:

- Scheduling hourly batch exports,

- Building a custom ETL job,

- And dealing with schema changes manually,

You can do the following with Estuary:

- Connect Oracle as a source using Estuary’s Oracle CDC connector

- Define a destination — in this case, BigQuery

- Create a data flow with a few clicks or a simple config

- Stream changes continuously — any insert, update, or delete in Oracle appears in BigQuery within seconds

Your downstream BI dashboards or ML models can now operate on real-time data—supporting faster, more accurate decision-making.

Why Not Just Use Traditional ETL?

Most financial institutions already have ETL pipelines in place, but these are typically batch-based, manually orchestrated, and difficult to scale.

Here’s how Estuary compares:

| Feature | Traditional ETL | Estuary |

| Data Freshness | Delayed (hourly/nightly) | Real-time (sub-second latency) |

| Complexity | Schedulers, scripts, manual effort | Declarative, low-code UI |

| Legacy system support | Often limited, batch-based | Native Oracle & SQL Server CDC |

| Schema drift handling | Manual updates required | Automatic schema propagation |

| Delivery guarantees | At-least-once or none | Exactly-once semantics |

| Observability & version control | External tooling required | Built-in monitoring & versioning |

By moving away from batch ETL to real-time sync, finance teams gain faster insights, reduce operational costs, and minimize data inconsistency across systems.

Compliance & Governance, Built-In

For financial institutions, compliance is not optional.

Estuary supports:

- Schema version tracking

- Granular logging and monitoring

- Secure credentials and encrypted data transfer

This makes it easier to pass audits and meet regulatory requirements (e.g., SOX, Basel III, GDPR) without building a separate governance stack.

Conclusion: Modernize Without the Rewrite

The finance industry doesn’t need another massive rewrite project. It needs incremental, reliable modernization that meets compliance requirements and unlocks real-time use cases.

Estuary lets you modernize at your pace without changing the systems you depend on. Whether you’re feeding real-time dashboards, enabling streaming analytics, or reducing your ETL costs, Estuary helps you bridge the gap between old and new.

Ready to Get Started?

- Talk to our team about your current data architecture

- Start building your first pipeline in minutes

- Dive into the docs to explore technical capabilities

FAQs

What are the best data pipeline solutions for finance startups?

Which data pipeline tools are best for tech startups in the finance sector?

How can finance teams modernize without rewriting legacy pipelines?

About the author

Emily is a software engineer and technical content creator with an interest in developer education. She has experience across Developer Relations roles from her FinTech background and is always learning something new.